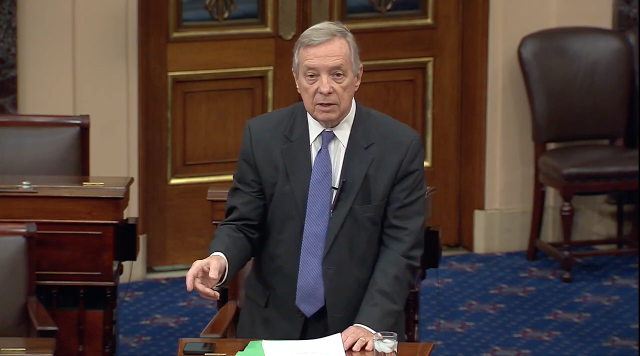

WASHINGTON – Today, U.S. Senate Majority Whip Dick Durbin (D-IL), Chair of the Senate Judiciary Committee, and U.S. Senator Roger Marshall, M.D. (R-KS) requested information from the U.S. Department of Transportation (DOT) and the Consumer Financial Protection Bureau (CFPB) about the actions they are taking to protect consumers against unfair and deceptive practices in airlines’ frequent flyer and loyalty programs. Millions of Americans participate in frequent flyer programs. While these programs may have originated to incentivize and reward true “frequent flyers,” they have evolved to include co-branded credit cards and now often exclusively focus on dollars spent using these co-branded credit cards. In the letter, the Senators requested that DOT and CFPB answer questions surrounding the deceitful marketing tactics of these frequent flyer programs.

Get The Latest News!

Don't miss our top stories and need-to-know news everyday in your inbox.

The Senators wrote, “At the same time, there are troubling reports that airlines are engaged in unfair, abusive, and deceptive practices with respect to these loyalty programs. For example, reports have suggested that airlines are changing point systems in ways that are unfair to consumers, including by devaluing points, meaning it takes more points than initially marketed to achieve the promised rewards.”

“These alleged behaviors are a function of frequent flyer programs’ unilateral contracts, which, per DOT rules, are only restricted by the guarantees that programs make in their terms of service. In practical terms, this means airlines can make changes to their points programs without notice to consumers, as long as the programs’ terms of service reserve the right to do so. As a result, these programs incentivize consumers to purchase goods and services, obtain credit cards, and spend on those credit cards in exchange for promised rewards—all while retaining the power to strip consumers of those rewards at any moment,” the Senators continued.

Airlines allow consumers to directly purchase points from the airlines’ websites. But the cost of directly purchasing points can sometimes be three times the value of the points at redemption. This means that consumers can spend three cents to purchase a point worth roughly one cent. This disparity between the value of points at purchase and at redemption can be even more extreme, depending on when, how many, and even where on the website the points are purchased.

Airlines also charge individuals for transferring points. However, individuals often lose the value of the points simply in the transfer—and that’s before adding the transaction fee.

The letter comes after several airlines’ CEOs falsely claimed that the Senators’ Credit Card Competition Actwill decimate credit card rewards. The airlines have negotiated sweet heart deals with the biggest Wall Street banks at the expense of consumers and local businesses for years. The EU put a hard cap on credit card swipe fees at .3% and their banks and airlines still offer points and miles programs.

The Credit Card Competition Act is bipartisan legislation that would enhance competition and choice in the credit card network market, which is currently dominated by the Visa-Mastercard duopoly. The legislation is estimated to save merchants and consumers $15 billion each year and Durbin recently urged the Senate to bring the bill to the floor for a vote. Durbin, Marshall, and Senator Peter Welch (D-VT) sent a letter to Visa and Mastercard insisting on an immediate reversal of their plans to increase credit card fees on merchants and consumers again this fall—a move that would cost American businesses and merchants an additional $502 million annually.

Text of the letter can be found here.

More like this: