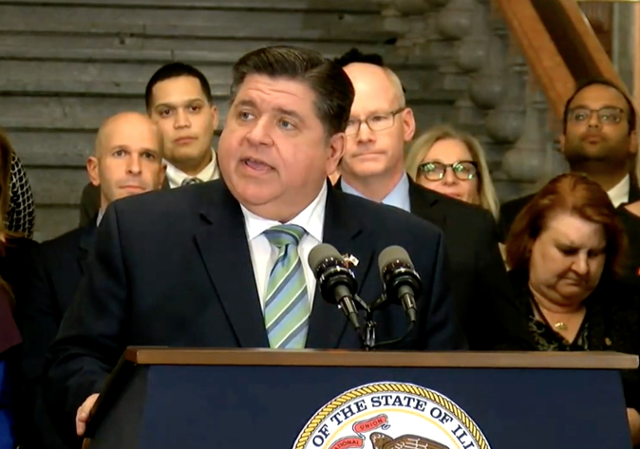

CHICAGO — Governor JB Pritzker announced $449 million in tobacco bonds have been retired through a defeasance, benefiting taxpayers through debt service savings and interest earnings in an aggregate of $50 million.

Get The Latest News!

Don't miss our top stories and need-to-know news everyday in your inbox.

“Today’s action reflects Illinois’ strong fiscal position and my continued commitment to responsibly manage the state’s financial resources as we pay off the lingering debts from the Great Recession,” said Governor JB Pritzker. “During my administration, we’ve eliminated the state’s multi-billion-dollar bill backlog, built up the state’s Rainy Day fund balance to nearly $2 billion, made $700 million in public pension payments above required amounts, received eight credit upgrades and worked to grow the economy to more than $1 trillion.”

The bonds represent what remained of a $1.5 billion debt associated with the Great Recession, dating back to 2010, when the state was struggling with a multi-billion bill backlog. The state traded annual payments it was due from a multi-state legal settlement agreement with various cigarette manufacturers for upfront cash from revenue bonds sold by the Railsplitter Tobacco Settlement Authority, a special purpose entity created by the state (30 ILCS 171). The borrowed cash was used to address unpaid bills in 2010.

The defeasance will set aside funds in a special escrow account until June 2026, when the remaining bonds are eligible for redemption, but the debt is considered immediately retired. The Governor recommended the action in his proposed Fiscal Year 2024 budget. Lawmakers endorsed it as part of the Fiscal Year 2024 spending plan they approved in May and the Railsplitter Board authorized the action.

Bond rating agencies have recognized Illinois’ fiscal progress. S&P Global Ratings in February raised the state’s rating to A-minus with a stable outlook from BBB-plus. Moody's Investor Service in mid-March upgraded the state to A3 and stable from Baa1. Fitch Ratings in late March lifted the state's outlook to positive from stable on its BBB-plus rating.

More like this: