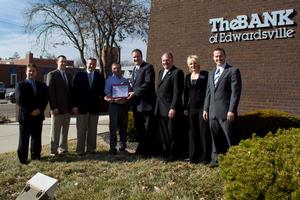

EDWARDSVILLE, ILL., February 25, 2011 . . . TheBANK of Edwardsville today announced that it received the top honor from the United States Department of Agriculture (USDA) Rural Development Program for closing more than $3.1 million in Guaranteed Rural Housing Loans during fiscal year 2010. Each year the USDA Rural Development Program recognizes lenders that excel in using the federal agency’s guaranteed loan program to increase home ownership among moderate income homebuyers ready to purchase their first home or upgrade to a better one.

EDWARDSVILLE, ILL., February 25, 2011 . . . TheBANK of Edwardsville today announced that it received the top honor from the United States Department of Agriculture (USDA) Rural Development Program for closing more than $3.1 million in Guaranteed Rural Housing Loans during fiscal year 2010. Each year the USDA Rural Development Program recognizes lenders that excel in using the federal agency’s guaranteed loan program to increase home ownership among moderate income homebuyers ready to purchase their first home or upgrade to a better one.

With the Rural Development guarantee, TheBANK of Edwardsville can offer 100 percent loans with no required down payment, no private monthly mortgage insurance (PMI), no maximum purchase price, competitive fixed interest rates, and 30 year terms. The program includes flexible credit guidelines and generous income limits. Guaranteed Rural Housing Loans are available to assist eligible households with incomes that do not exceed 115% of the medium income for the area.

Get The Latest News!

Don't miss our top stories and need-to-know news everyday in your inbox.

“In this difficult housing market, TheBANK of Edwardsville is committed to using Rural Development’s guaranteed home loan program to help as many homebuyers as possible reach their dreams of owning a home,” said Steve Fuehne of TheBANK of Edwardsville. “This past year we were able to put 26 homebuyers into a new home, utilizing this program in every way possible to make their dreams of homeownership a reality. Our customers have embraced the Guaranteed Loan product and have been thrilled with the opportunity to take advantage of the loan’s features and flexibility, making it easier for them to own their dream home, even in this economy.”

The Guaranteed Rural Housing Loans also have flexible credit standards, expanded qualifying ratios, no maximum purchase price limits and generous income limits.

According to Bob Trost, a Rural Development specialist in the agency’s Edwardsville office, “TheBANK of Edwardsville has been an important asset to the area’s homebuyers, especially during this difficult housing market. Their commitment to making homeownership affordable and keeping the American dream alive for families and individuals living in the area is commendable.”

Rural Development made $438 million in guarantees available for 4,785 homebuyers in Illinois in the last fiscal year. The agency works with lenders to ensure that housing in rural areas is affordable and safe. Availability of quality housing is a key component of economic stability in rural areas.

For more information about the Guaranteed Rural Housing Loan or other loan products of TheBANK of Edwardsville, please call (618) 656-0098 or visit www.4thebank.com.

TheBANK of Edwardsville, with its theme: “Because We Care,” has assets exceeding $1.45 billion and a long tradition of providing personal service, offering innovative products and giving back to the communities in which it serves. For more information, please visit www.4thebank.com

More like this: