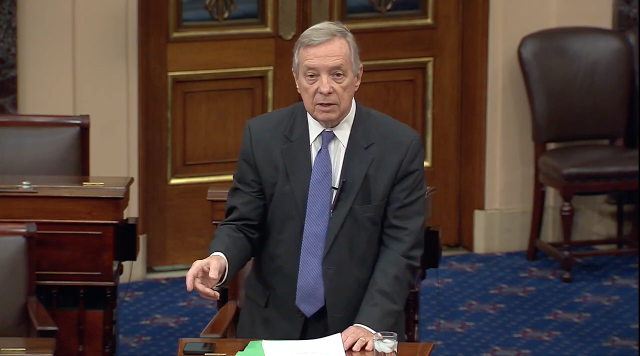

WASHINGTON – U.S. Senate Majority Whip Dick Durbin (D-IL), and U.S. Senators Elizabeth Warren (D-MA) and Tina Smith (D-MN) requested answers from Fidelity Investments on their decision to allow 401(k) plan sponsors to offer plan participants exposure to Bitcoin, a highly volatile and unregulated digital asset. Fidelity is one of the largest 401(k) providers with around 40 million individual investors and around $11.3 trillion in assets under administration.

Get The Latest News!

Don't miss our top stories and need-to-know news everyday in your inbox.

The letter said in part, “we write today to ask why Fidelity, a trusted name in the retirement industry, would allow plan sponsors the ability to offer plan participants exposure to Bitcoin. While plan sponsors ultimately are responsible for choosing the investments available to participants, it seems ill advised for one of the leading names in the world of finance to endorse the use of such a volatile, illiquid, and speculative asset in 401(k) plans-which are supposed to be retirement savings vehicles defined by consistent contributions and steady returns over time.”

In the letter, the Senators raise various concerns about potential risks and financial dangers posed by digital assets like Bitcoin.

“While we appreciate Fidelity's efforts to help working Americans realize a more secure retirement, this decision is immensely troubling. Perhaps most troubling is that in pointing to the risks of investing in Bitcoin on its website and planning to cap plan participants' Bitcoin exposure to 20 percent, Fidelity is acknowledging it is well aware of the dangers associated with investing in Bitcoin and digital assets, yet is deciding to move ahead anyway… Retirement accounts must be held to a higher standard, one that Bitcoin and other unregulated digital assets fail to meet. This asset class is unwieldy, immensely complex, unregulated, and highly volatile. Working families' retirement accounts are no place to experiment with unregulated asset classes that have yet to demonstrate their value over time,” the Senators continued.

A copy of the letter can be found here.

More like this: