WASHINGTON — U.S. Senate Majority Whip Dick Durbin (D-IL) and U.S. Senator Roger Marshall, M.D. (R-KS) introduced two amendments to the National Defense Authorization Act (NDAA) to address excessively high credit and debit card swipe fees that burden American consumers, small businesses, and veterans. Their first amendment would direct the Department of Defense (DoD) and the Treasury Department to issue a report about a current law, 10 USC 1065, that requires some veteran populations including Purple Heart awardees, Medal of Honor recipients, former POWs, veterans with service-connected disabilities, and veteran family caregivers, to pay surcharge fees for using credit or debit cards at military commissaries to cover the cost of the swipe fees. The report would ask for information from the last fiscal year on how much is being charged in these fees, which card networks and banks are receiving the fees, how much each category of veteran is being charged, and whether any banks or networks are reimbursing the swipe fees in order to spare the veterans from being surcharged for the fees.

Get The Latest News!

Don't miss our top stories and need-to-know news everyday in your inbox.

Their second amendment is Durbin and Marshall’s bipartisan Credit Card Competition Act of 2022, legislation that would enhance competition and choice in the credit card network market, which is currently dominated by the Visa-Mastercard duopoly. Building off of debit card competition reforms enacted by Congress in 2010, the bill would direct the Federal Reserve to ensure that giant credit card-issuing banks offer a choice of at least two networks over which an electronic credit transaction may be processed, with certain exceptions. Representatives Peter Welch (D-VT) and Lance Gooden (R-TX) introduced the House version of the bill.

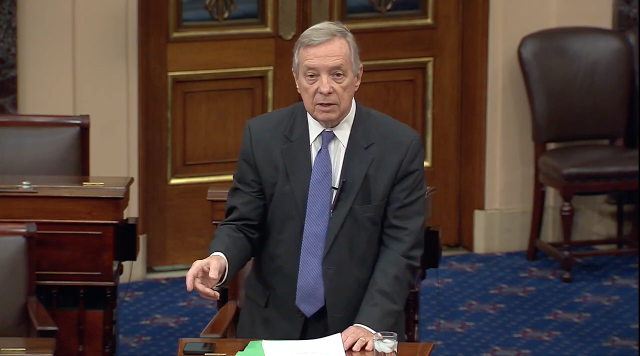

“For years I have worked to bring fairness and competition to credit and debit card swipe fees,” said Durbin. “These swipe fees inflate the prices that consumers pay for groceries and gas, and, incredibly, veterans are being charged extra for commissary purchases because of these exorbitant fees. That’s outrageous, and we’re going to find out which banks and card networks are profiting off of these surcharges on our heroic veterans. With these amendments, we can bring real competition to credit card networks to help reduce swipe fees and hold down costs for Main Street merchants and their customers; and bring transparency to the shameful surcharge fees inflicted upon our veterans.”

"Our American heroes are being taken advantage of at commissaries across the U.S. at a time when they, and the country they serve, are grappling with crippling inflation and an ongoing recession. As credit card swipe fees continue to increase at a rate detached from reality, it is critical we make sure those who served and are serving this country are not being unfairly taken advantage of. The first step for fixing this problem is measuring it, and our amendment will give us the much-needed information to address the out-of-control swipe fees that are wreaking havoc on all Americans. As Senator Durbin and I continue our bipartisan efforts to rein in swipe fees, I am proud to team up with him once again on these important NDAA amendments,” said Marshall.

Visa and Mastercard wield enormous market power in credit cards; according to the Federal Reserve, they account for nearly 576 million cards, or about 83 percent of general-purpose credit cards. Approximately $3.49 trillion was transacted on Visa and Mastercard credit cards in the U.S. in 2021. Visa’s and Mastercard’s market power and network structure have enabled them to impose fees on U.S. merchants that are among the world’s highest, charging a total of $77.48 billion in U.S. merchant credit card fees in 2021. These fees include interchange or swipe fees which Visa and Mastercard require merchants to pay to issuing banks, as well as network fees that Visa and Mastercard require merchants to pay directly to them. Consumers ultimately pay for all of these fees in the price of the goods and services they buy.

More like this: